draftkings tax forms|Sports Betting Taxes: How to Handle DraftKings, FanDuel : Bacolod Tax FAQs. Why am I being asked to fill out an IRS Form W-9 for DraftKings? (US) How do I update personal information on my tax forms (1099-Misc / W-2G) for DraftKings? (US) . Lootedpinay.com delivers best Pinay Porn and Pinay Sex Scandal Video For You - Stream viral amateur porn and trending sex scandals from KATORSEX and KAYATAN sites

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · Understanding Your DraftKings Tax Withholding: Key Strategies and Rul

PH3 · Understanding Your DraftKings Tax Withholding: Key Strategies

PH4 · Taxes – DraftKings Help Center (US)

PH5 · Taxes on Draftkings/Fanduel. I'm confused : r/dfsports

PH6 · Tax FAQs – DraftKings Help Center (US)

PH7 · Statements, Taxes and Documents on DraftKings – Overview

PH8 · Statements, Taxes and Documents on DraftKings

PH9 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH10 · Never got tax form from fanduel/draftkings. Please help

PH11 · DraftKings Tax Form 1099

PH12 · DraftKings

Best Mega Gyarados counters. The best Mega Gyarados counters in Pokémon GO are Mega Lucario, Mega Sceptile, Mega Heracross, Mega Gardevoir, Shadow Conkeldurr, Kartana, and Terrakion. These Pokémon perform best with the moves outlined below. We suggest a minimum group size of 3 - 7 Trainers to defeat Mega Gyarados in a Mega .

draftkings tax forms*******If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax .Tax FAQs. Why am I being asked to fill out an IRS Form W-9 for DraftKings? (US) .

Sports Betting Taxes: How to Handle DraftKings, FanDuelYou must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account .Taxes. Tax information, forms, and key dates. Where can I find my DraftKings .Tax FAQs. Why am I being asked to fill out an IRS Form W-9 for DraftKings? (US) How do I update personal information on my tax forms (1099-Misc / W-2G) for DraftKings? (US) .

You are only going to get a tax document if you net out more than $600. If you netted out more than $600 on fanduel and there is no tax form available for you to download, .

Learn how to access your DraftKings tax form online or by mail if you have won over $600 from sports betting, fantasy sports, or casino games. Find out how to report your winnings and losses on .

draftkings tax forms Learn how to report your gambling winnings from DraftKings and other platforms on your tax return. Find out if you need to pay income tax, self-employment .

You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing is prohibited. This site is protected by reCAPTCHA and the Google and apply. The best .

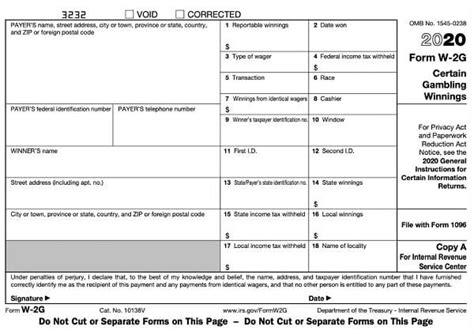

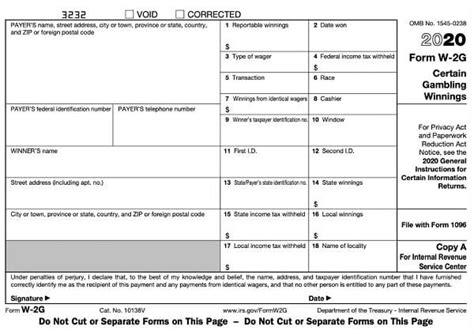

Explore the labyrinth of tax withholding for DraftKings winnings in our latest article. Learn about key procedures like the Form W-2G for prizes over $600, the 24% . Understanding Taxes on Winnings on DraftKings. All winnings from sports betting are subject to federal and state taxes. It’s crucial for players to report and pay .draftkings tax forms Sports Betting Taxes: How to Handle DraftKings, FanDuelI heard past $600, I need to pay taxes for my gambling winnings. My winnings on Draftkings and Fanduel combined, is around $1000. I'm a college student who doesn't .

Taxes. Tax information, forms, and key dates. Where can I find my DraftKings tax forms / documents (1099/ W-2G)? (US) How do I get a Win/Loss Statement from DraftKings? .Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal .To ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details.. Note: Fantasy app customers can update their IRS Form W-9 via desktop, laptop, or mobile web.

You may contact the DraftKings Customer Support Team to request a Win/Loss Statement that details your account activity for a requested time period. To understand how your Win/Loss Statement can be used during tax preparation, DraftKings suggests that you consult with a tax professional. For more information on gambling income and .

Tax information, forms, and key dates. Key Dates. Key tax dates for DraftKings - 2023 (US) Forms. Where can I find my DraftKings tax forms / documents (1099/ W-2G)? (US) How do I get a Win/Loss Statement from DraftKings? (US) Is there documentation to help me claim credit for IRS withholdings? (US)

ADMIN MOD. DraftKings tax implications. Taxes. I recently deposited about $50 in DraftKings and have grown that amount to around $800 (mostly luck). After some doing research on my own, is it correct that I will be taxed on the gain of each individual win? So if I have $1,200 in wins, but $400 in losses, I will be taxed on the $1,200 unless I .

DraftKings Help Center (US) My Account; Tax Information; Tax Information Are my winnings on DraftKings subject to state interception? (US) Additional Ways to Contact Us. Mail: US Office. 222 Berkeley St. Boston, MA 02116. Support Hours. Our team is available 24 hours a day, 7 days a week. . All winnings from sports betting are subject to federal and state taxes. It’s crucial for players to report and pay any due taxes. For winnings exceeding $600 in a year, DraftKings issues a 1099 form. This form reports total winnings for tax purposes. Locate these documents in the “Account” section of your DraftKings account. Explore the labyrinth of tax withholding for DraftKings winnings in our latest article. Learn about key procedures like the Form W-2G for prizes over $600, the 24% federal tax withholding for wins above $5,000, and specific state tax thresholds. Unearth tips on record-keeping, itemized deductions, and the importance of professional tax .

When it comes to the best PvP Steam games, Team Fortress 2 has longevity and quality on its side. War Thunder . Video Games. Steam. Apex Legends. Your changes have been saved. Email is sent.Ethereum online casinos come in various types, but they all have a unique thread tying them together: they use the Ether (ETH) cryptocurrency for deposits and withdrawals. Essentially, an Ethereum casino is an online platform where you .

draftkings tax forms|Sports Betting Taxes: How to Handle DraftKings, FanDuel